Values and dates

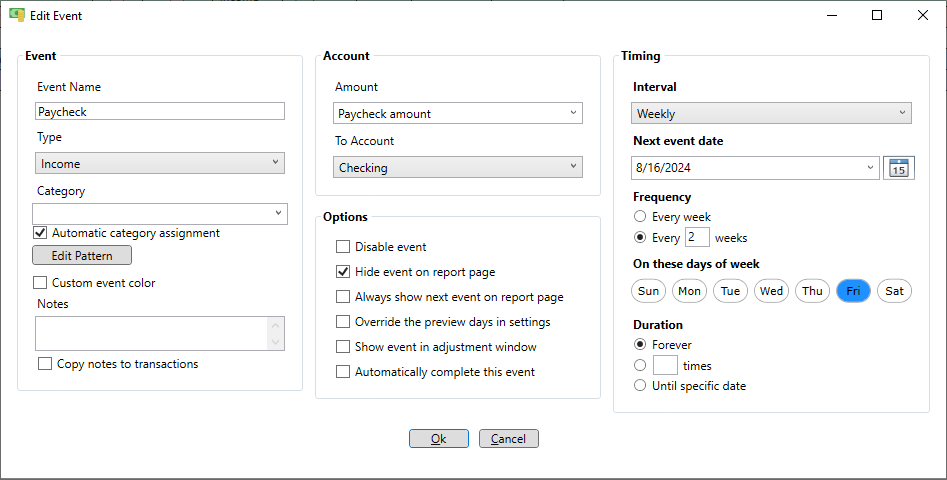

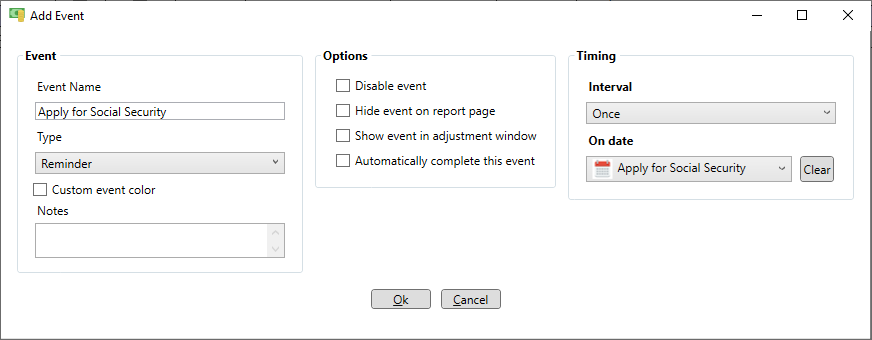

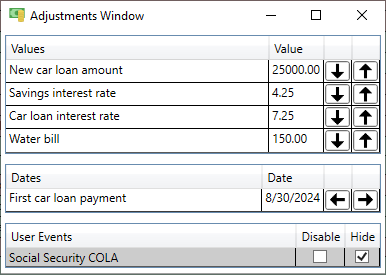

Creating values and dates and using them in events allows the "Adjustments" feature on the schedule page to work. This feature allows disabling or hiding specified events or making incremental changes to values or dates and observing the effect on the account balances in real time. Creating values and dates can also make things more readable by using formulas to calculate new values or modifiers to change a date. Values and dates can be created on the events page by clicking the "Values" or "Dates" menu button. This opens a window which shows the currently defined values or dates and allows new entries to be added or existing entries to be edited, deleted or rearranged.

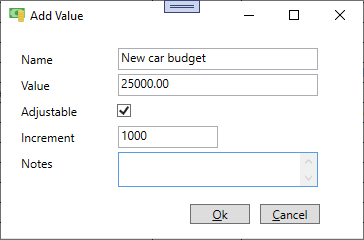

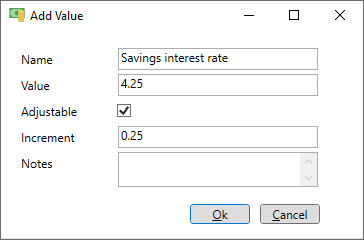

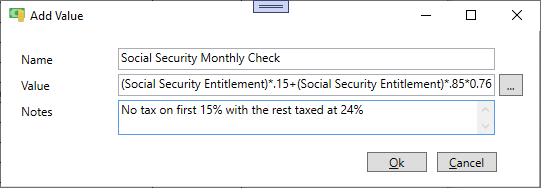

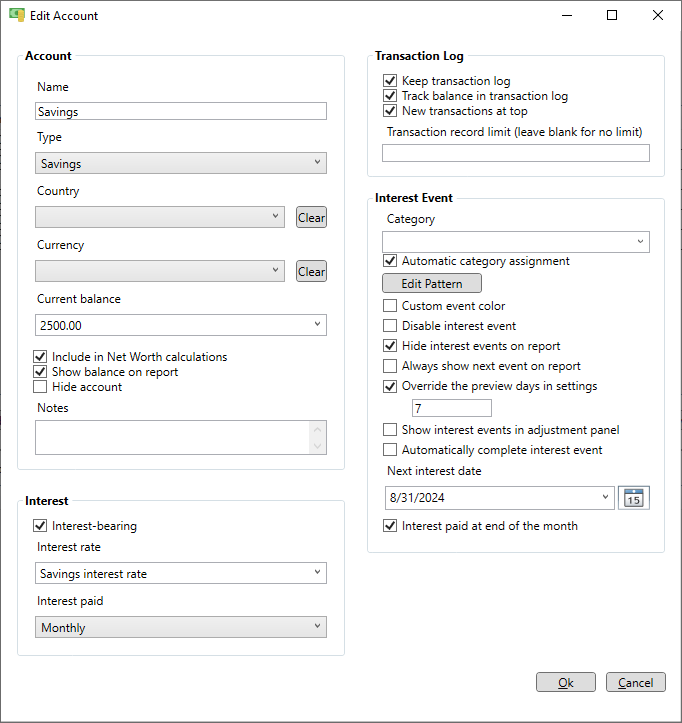

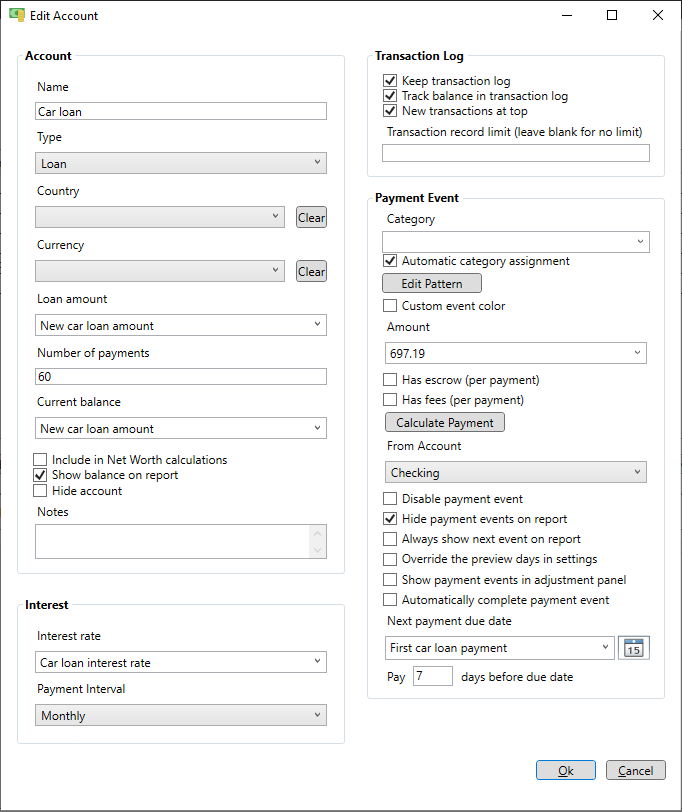

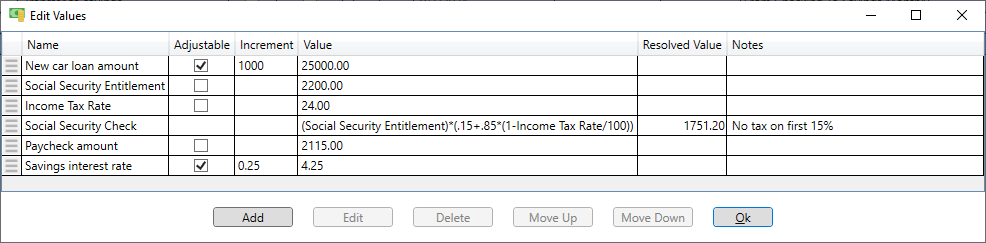

The values window shows the currently defined values and allows adding, editing, deleting or reordering the values. The values are displayed in a grid form with one row per value. There is a column for the name, the "Adjustable" flag, the adjustment "Increment", the "Value", "Resolved Value" and "Notes". The "Resolved Value" column shows a calculated value for any values that use a formula or refer to another value. If the formula can't be resolved a red background is shown. Adjustable values show up in the adjustments window which floats independently of the application and allows you to instantly see how changing a value affects your budget. Note that values defined using a formula can't be adjustable. Only values that are simple numbers can be adjustable. Just assign the dollar amount of an event to an adjustable value, go to the schedule page and open the adjustments window. Using values can give you insight into how changes affect your budget. For example, you can assign an adjustable value to the interest rate on your loan, savings or 401k to see how changing that rate affects your budget years later. Or use an adjustable value to see how changing the down payment on a new loan affects your budget.

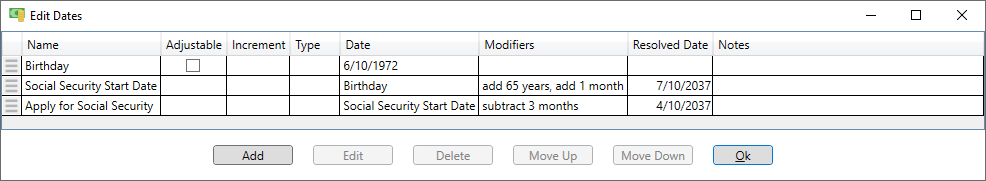

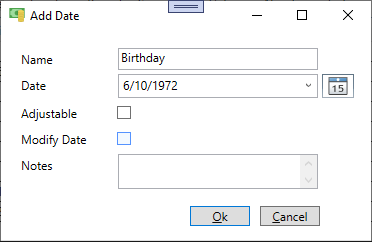

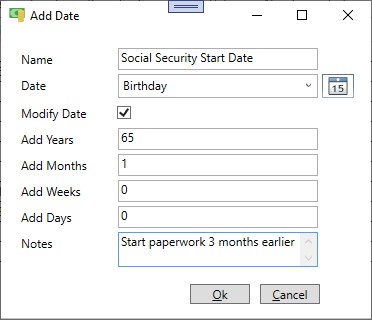

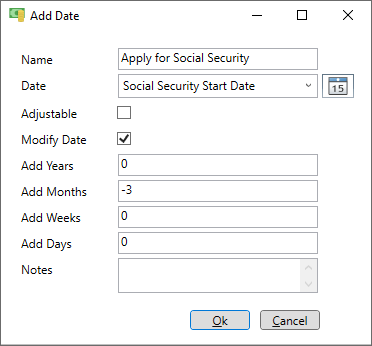

The dates window shows the currently defined dates and allows adding, editing, deleting or reordering the dates. The dates are displayed in a grid form with one row per date. There is a column for the name, the "Adjustable" flag, the adjustment "Increment", increment "Type", the date, "Modifiers", the "Resolved Date" and "Notes". The "Resolved Date" column shows a calculated date for any dates that use modifiers and/or reference other dates. If the date can't be resolved a red background is shown. Adjustable dates show up in the adjustments window which floats independently of the application. Use adjustable dates when defining an event then go to the schedule page and open the adjustments window. Like adjustable values, using adjustable dates can help you see how changes affect your budget. For example, you can assign an adjustable date to your retirement event and see how changing that date affects your retirement savings.