Add accounts

Accounts are added on the account page. To get to the account page just click on the "Accounts" icon on the main menu at the top. Click the "Add" button below the account list to add an account. Note that the "Add" button below the lower list is for adding transactions to the selected account.

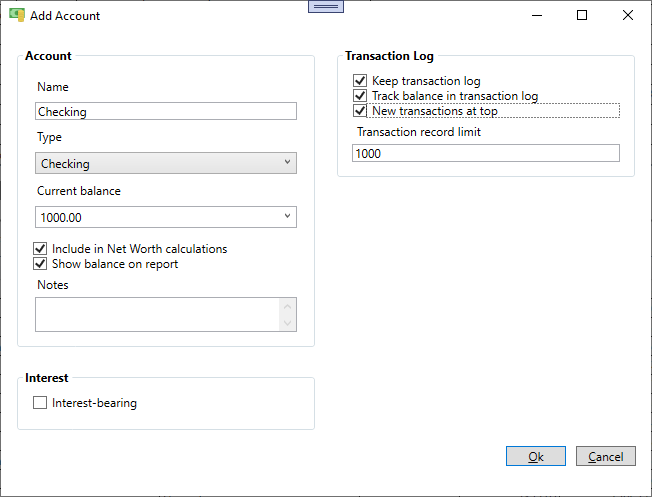

Add a checking account

For most people the checking account is where most pay bills are paid from. The name can be anything you want but for this example it is named "Checking". The type must be set to "Checking". Enter the current balance then select the recommended options by checking the appropriate boxes as shown below. When done click the Ok button.

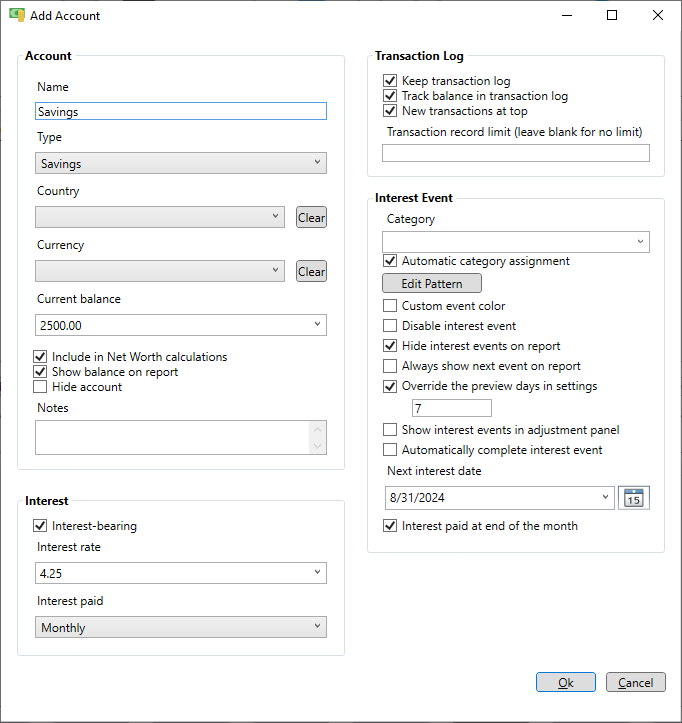

Add a savings account

The savings account name can be anything you want but for this example it is simply "Savings". The type must be set to "Savings". Enter the current balance then select the recommended options by checking the appropriate boxes as shown below. Note that savings accounts pay interest so the "Interest-bearing" checkbox is checked and an interest rate has been entered. Also the "Next interest date" must be selected. In this case the interest is paid at the end of the month. Interest events are internally generated for any account that is interest bearing. Note that we are hiding the interest events on the schedule page unless they are within 7 days to avoid a cluttered schedule. This is done with the "Override the preview days in settings" checkbox. When done click the Ok button.

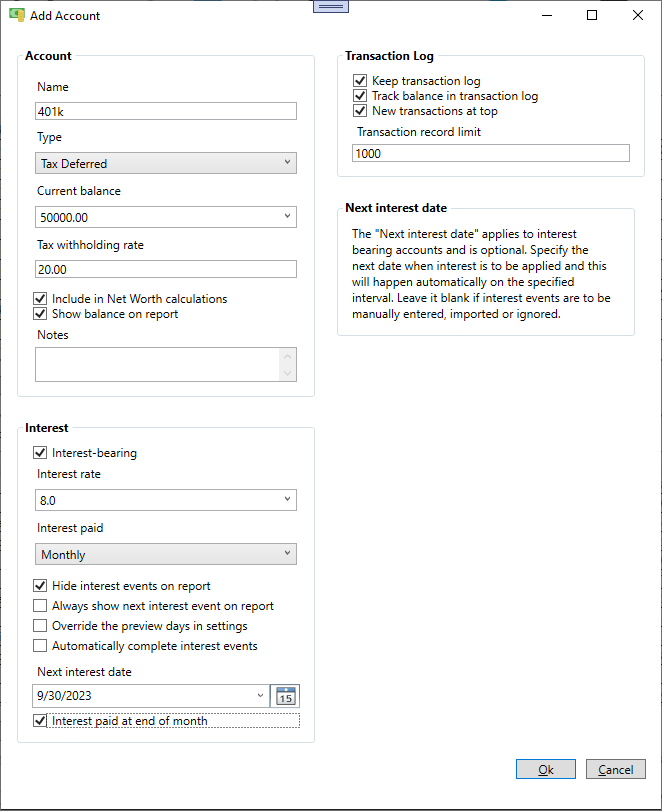

Add a tax deferred account

A tax deferred account, like a 401k or IRA, is just like a savings account except that gains in the account are not taxed until a withdrawal is made. If money is transferred out of the account then taxes are withheld according to the "Tax withholding rate" entered. To create a tax deferred account enter the name and select "Tax Deferred" for the type. Enter the current balance and check the "Interest-bearing" checkbox. Your tax deferred account is probably not just cash earning a specific interest rate, but you can make an assumption about how much your account will grow over time even if it is a mix of stocks, bonds, CD's or other investments. If you have an aggressive portfolio that is heavy on stocks you will probably earn more, about 10% per year on average, than one that is only in CD's. Enter your expected annual growth rate as the interest rate, but remember that it is better to assume a lower growth rate to ensure you will actually meet the projected balances. Enter the interest rate for your tax deferred account and the interval when the interest is paid. In the "Interest Event" section enter the next interest date". Like a savings account the interest events are generated internally and appear on the schedule page with all the other events.

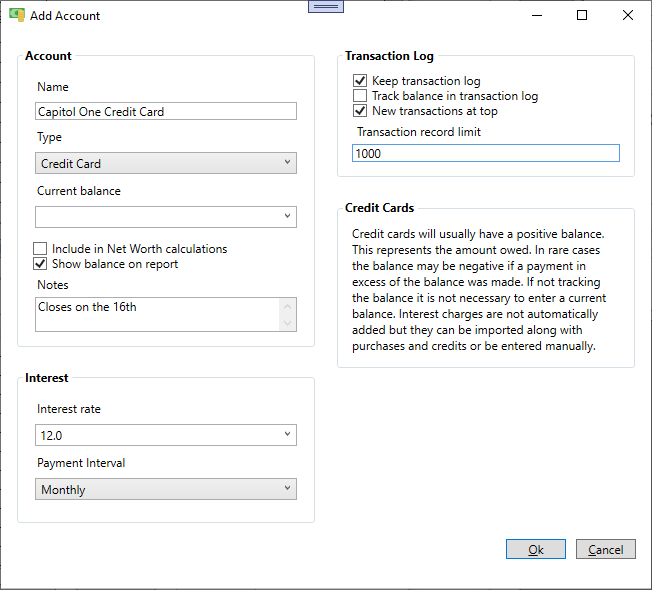

Add a credit card account

Enter an appropriate name for the credit card and select the "Credit Card" type. If you pay the credit card off every month there is no reason to track the balance, but it is optional. The "Interest rate" field is just for your information. It is not used for any calculations and can be left empty. For the payment event enter an average amount you would pay on this credit card every month. You could just enter 0 but to predict future balances it is best to put in an average.

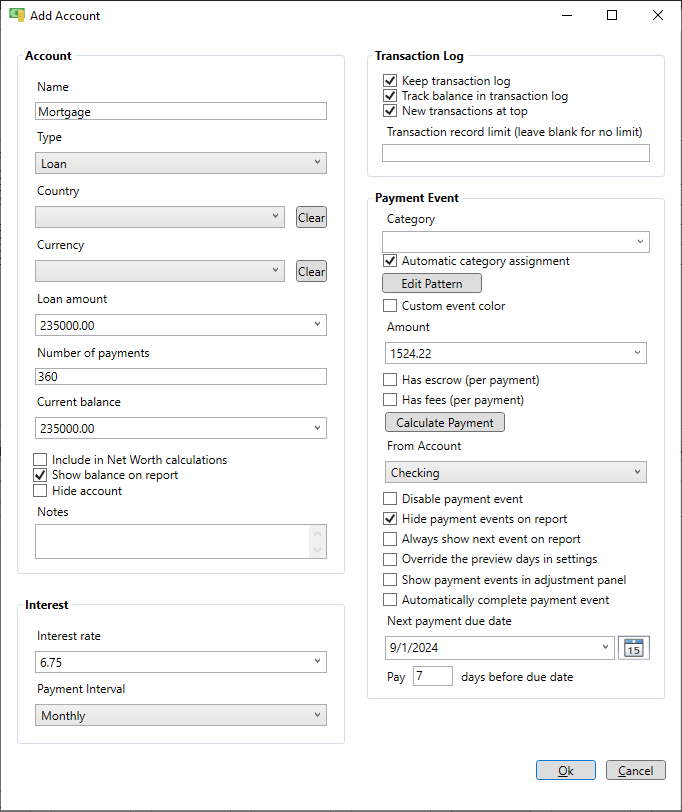

Add a mortgage

Enter a name for the mortgage account and select the "Loan" type. Enter the loan amount, total number of payments for the loan and current loan balance. Enter the interest rate and payment interval. If there is an escrow payment check the "Has escrow" box and enter the amount. Same for any fees that required per payment. Once that information is entered press the "Calculate Payment" button to automatically calculate the payment amount. Next select which account the payment will come from, the next due date and how many days before the due date you want to make the payment. When done click the Ok button. The new mortgage account is added and the accounts page will update. The payment event is automatically generated for the schedule page from the information supplied so no seperate payment event is needed.

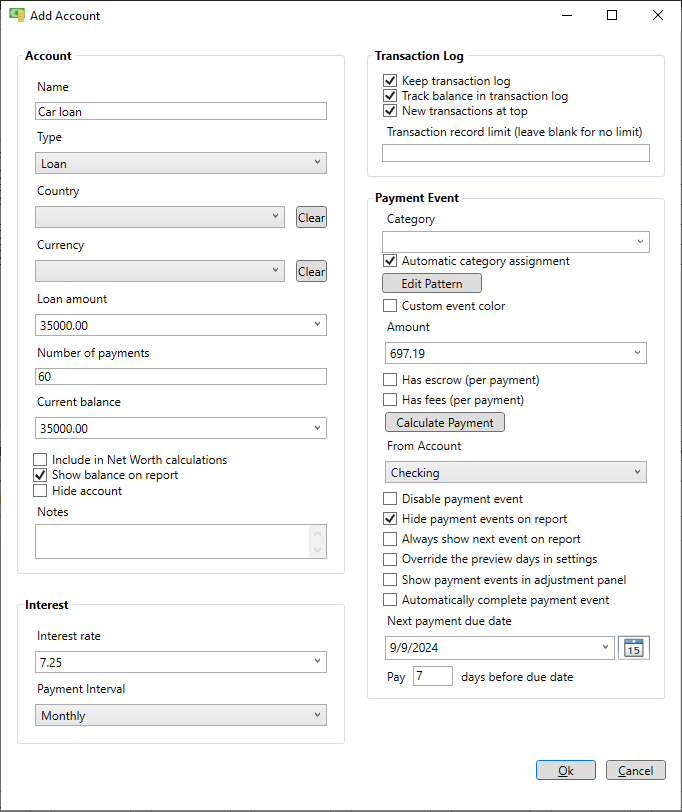

Add a car loan

Enter a name for the car loan and select the "Loan" type. Enter the loan amount, total number of payments for the loan and current loan balance. Enter the interest rate and payment interval. Typically car loans don't have escrow or fees so those can be left blank. Enter the payment amount or press the "Calculate Payment" button to automatically calculate the payment. Next select which account the payment will come from, the next due date and how many days before the due date you want to make the payment. When done click the Ok button. The new mortgage account is added and the accounts page will update. The payment event is internally generated from the information supplied so no seperate payment event is needed.