Add events

Events are added on the events page. Just click the "Events" icon in the main menu at the top and the events page is shown. Typical events would be a paycheck, rent, credit card payment or various expenses. Payment events for things like car loans or mortgages are setup when adding the account, but the rest are done here on the events page. Let's start by adding a paycheck event. Go to the event page by clicking on the "Events" icon in the menu bar. To add an event click the "Add" button. This brings up the "Add Event" window. All events have an interval that defines how often they occur. The interval can be "Once" if the event only happens once or it can be a repeating event. There are many options to define how often an event repeats. For example, if the interval is "Weekly" you can optionally select one or more days of the week. If the interval is "Monthly" you can select which months the event occurs on and which days in the month it occurs. For events that result in a transaction you can also assign a category to the event so when the event is completed the transaction created will have the category selected.

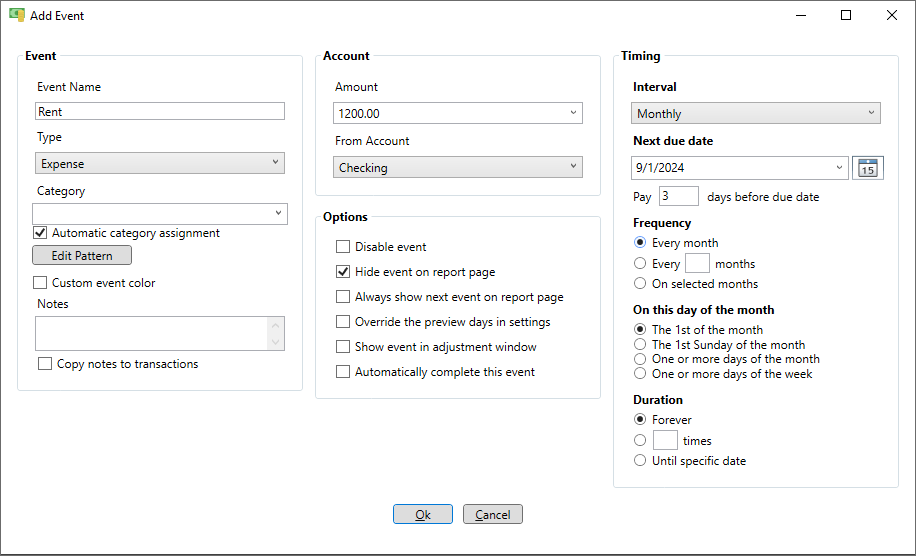

When creating events there are a couple good habits to consider. First, it is a good idea, when possible, to pay bills well before they are due. To allow for this there is an optional field below the "Next due date" to pay the bill a specific number of days before the due date. When this option is used the date shown on the schedule page for each event instance will be before the due date by the number of days specified. Another good practice is to hide future event instances unless it is within the preview period (which defaults to 30 days). This avoids a cluttered schedule.

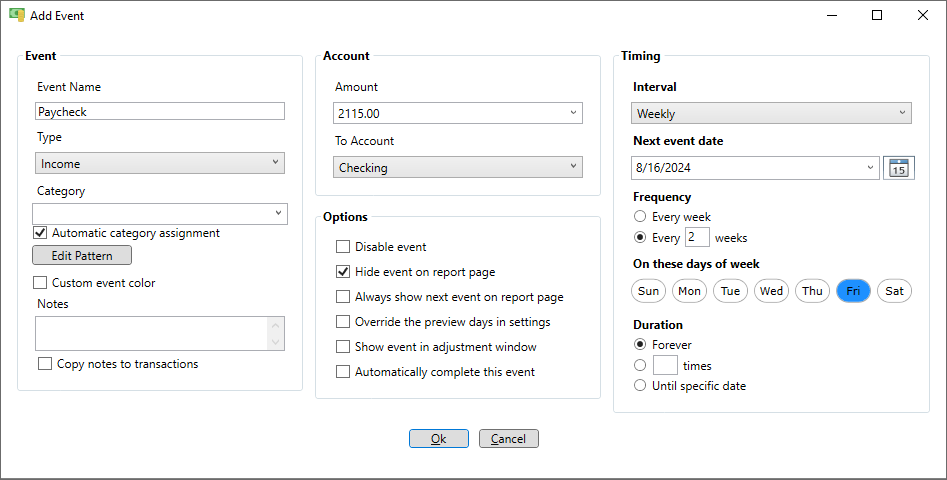

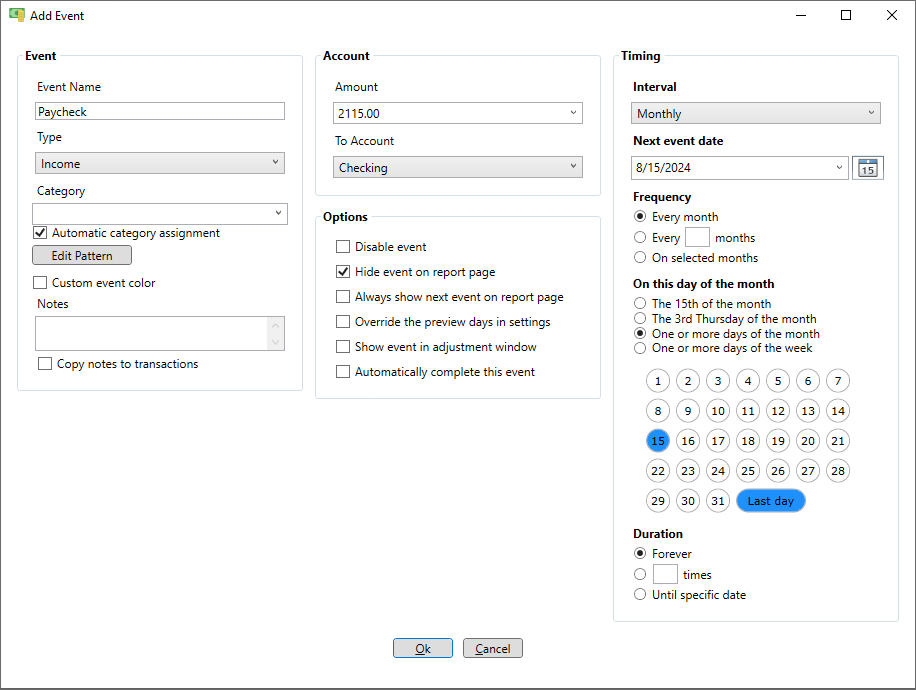

Add a paycheck event

Enter the name of the event, such as "Paycheck" in the example below, then select a type of "Income". Enter the typical paycheck amount and how often you get paid. In the example below the paycheck is on Friday every 2 weeks. If your paycheck varies you can just enter an average. When you get paid you can enter the actual amount when completing the event.

If you get paid twice a month (like on the 15th and at the end of the month) you can do that too. Just look at the example below.

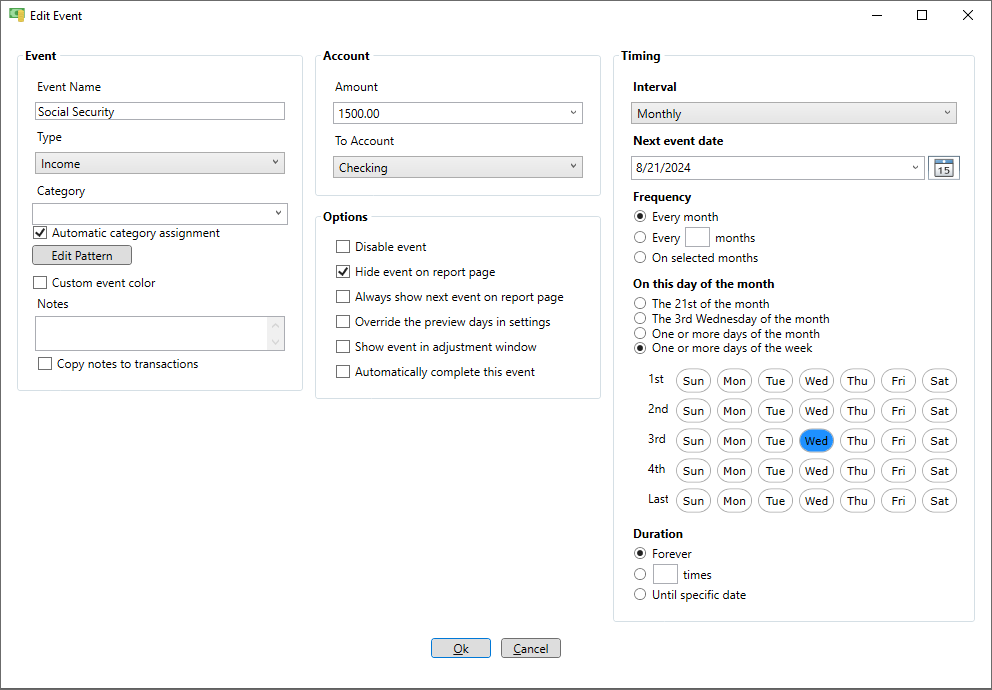

If you get income from Social Security it will be on a specific week and day of the week every month. In the example below it is on the third Wednesday.

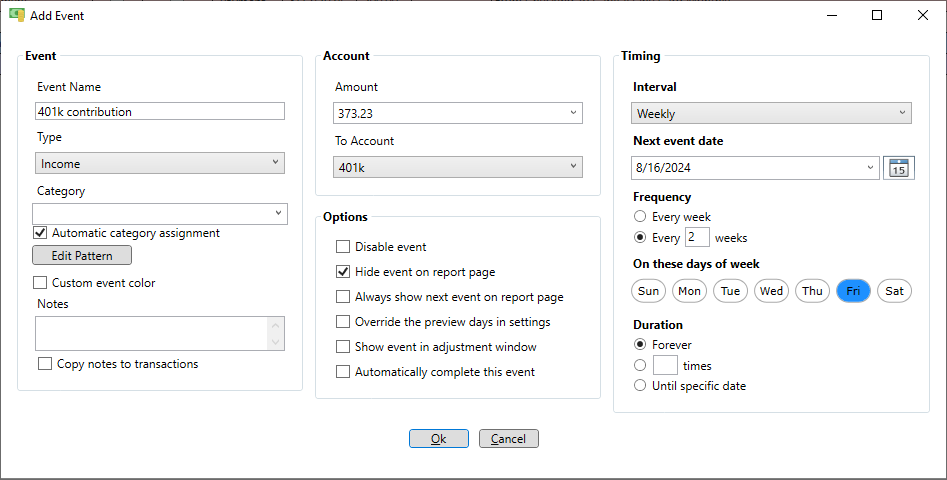

Add a 401k deposit event

If you are working and contributing to a 401k create an event to add these funds to your 401k. Enter the name of the event then select a type of "Income". Enter the typical contribution amount and set the interval to match your paycheck. In the example below the paycheck is on Friday every 2 weeks.

Add an expense event

Expenses could be rent, utility bills, tuition, taxes, subscriptions or any other expense. On the "Add event" window enter a name for the expense and select "Expense" for the type. Enter the amount and the "From Account" where the funds will come from then select the interval and the next payment due date. It always good to pay expenses a few days in advance so under "Next due date" enter your preference. If the amount of the expense varies just enter an average, expected or budgeted amount. At a later time the amount of the payment can be changed by editing the event instance or while completing the event. It's also a good idea to assign a category here so that when you complete the event the transaction has the appropriate category.

Add a transfer to savings event

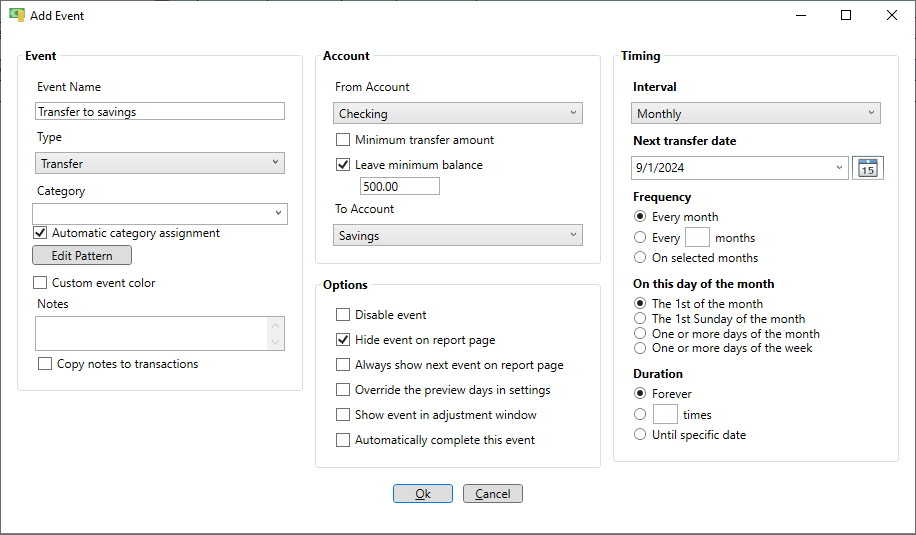

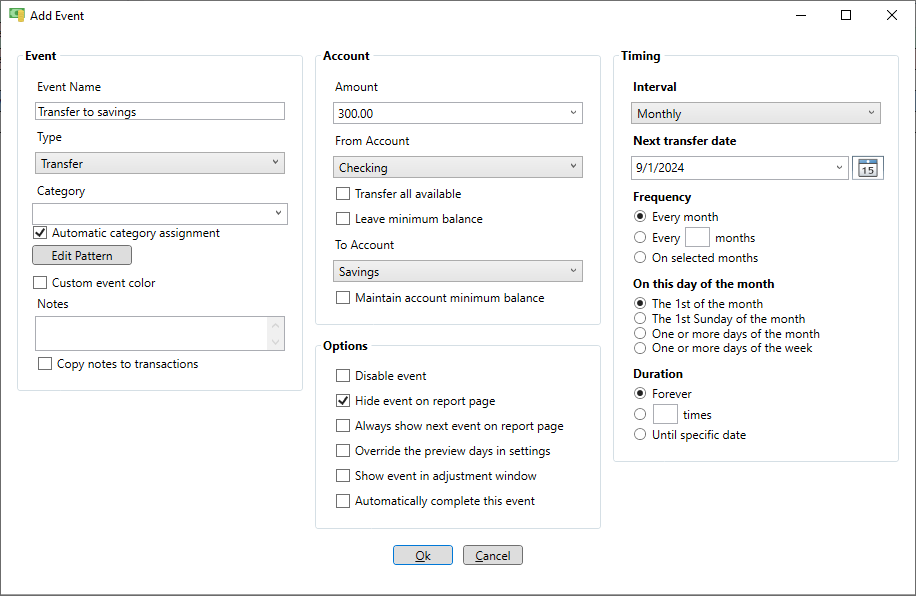

If you are saving for retirement you can create a transfer event to move money from your main account, like checking, to savings. Just enter a name for the transfer event and set the type to "Transfer". You can either set a specific amount of money to transfer or you can have the amount calculated for you by specifying a minimum balance to be maintained in main account.

Here is an example where the amount of the transfer is calculated so as to leave at least $500 in the checking account.

Here is an example where the amount of the transfer is a fixed amount.

Add a transfer from savings event

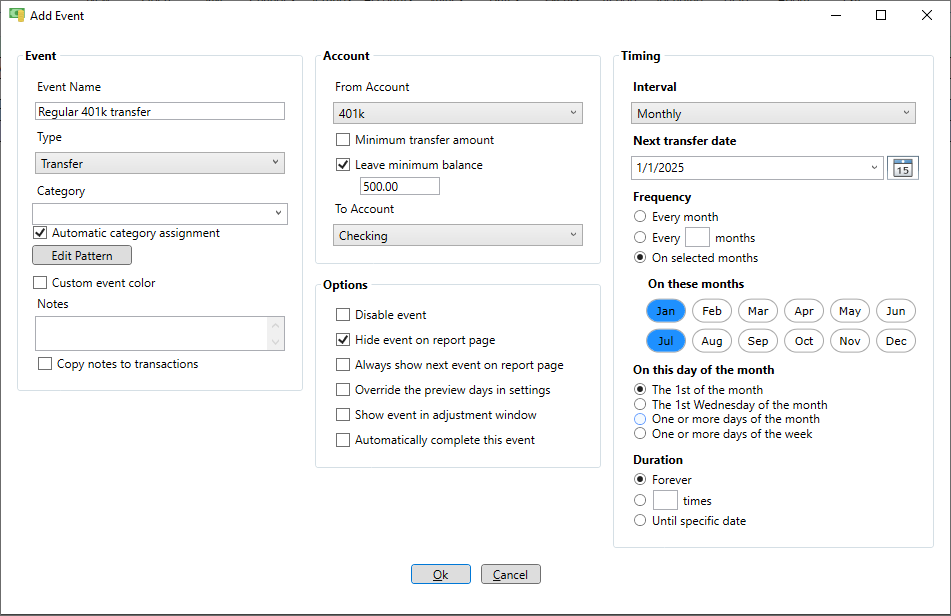

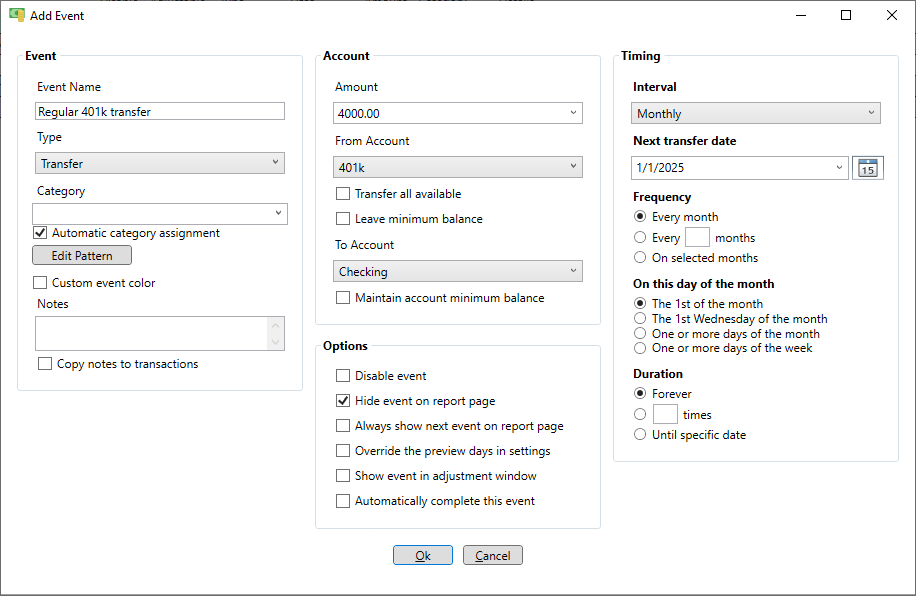

If you are retired you might need to transfer money from a savings or retirement account. To do this create a transfer event to move money from your savings or tax deferred account to your main account, like checking. Enter a name for the transfer event and set the type to "Transfer". You can either set a specific amount of money to transfer or you can have the amount calculated for you by specifying a minimum balance to be maintained in main account.

Here is an example where the amount of the transfer is calculated so as to maintain a balance of at least $500 in the checking account. Also, the transfer happens twice per year on January 1st and July 1st. Note that when money is transferred out of a tax deferred account taxes are withheld according to the "Tax withholding rate" specified in the settings for that account. For example, if you have a withholding rate of 22 percent in your 401k account and you are transferring $1950 to checking then $2500 will be pulled from your 401k with $550 withheld by your institution for taxes (2500 * 0.22 = 550).

Here is an example where the amount of the transfer is a fixed amount.

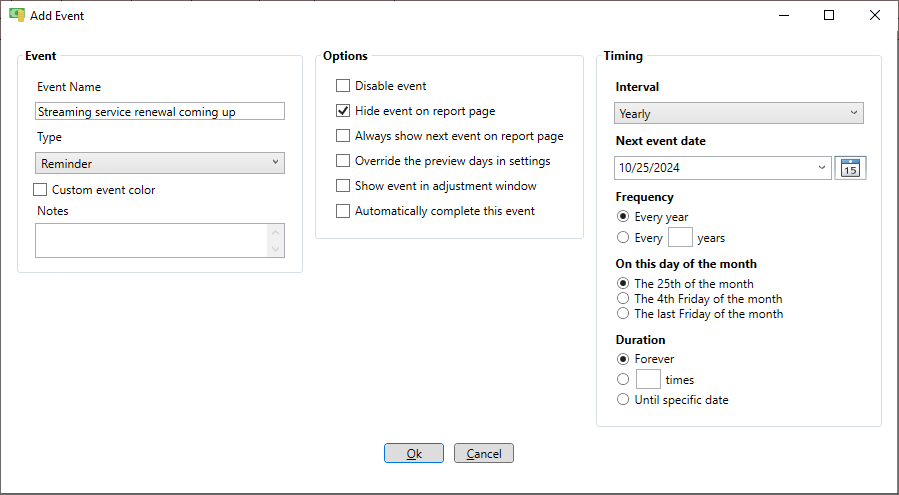

Add a reminder event

Reminder events have have no effect on anything. They are simply there as a convenience to remind you to do things related (or even unrelated) to your finances. On the "Add event" window enter a name for the reminder and select "Reminder" for the type. One very helpful reminder would be for an upcoming service renewal so you can consider canceling that service before it renews. Other common renewals would be to change the AC filters in your house, get your car serviced or fertilize the lawn.